The Importance of a Strong Credit Score

A good credit score is important to maintain financial stability and success. It plays an essential role in securing loans, qualifying for favorable interest rates, and even influencing your ability to rent a home or get a job. Building a strong credit score might seem challenging, but with the right steps and consistency, anyone can improve their score over time. Key factors like timely payments, managing credit utilization, diversifying your credit portfolio, and monitoring your credit report regularly are crucial to maintaining a healthy score. This guide will take you through the steps to help you build and maintain a strong credit score.

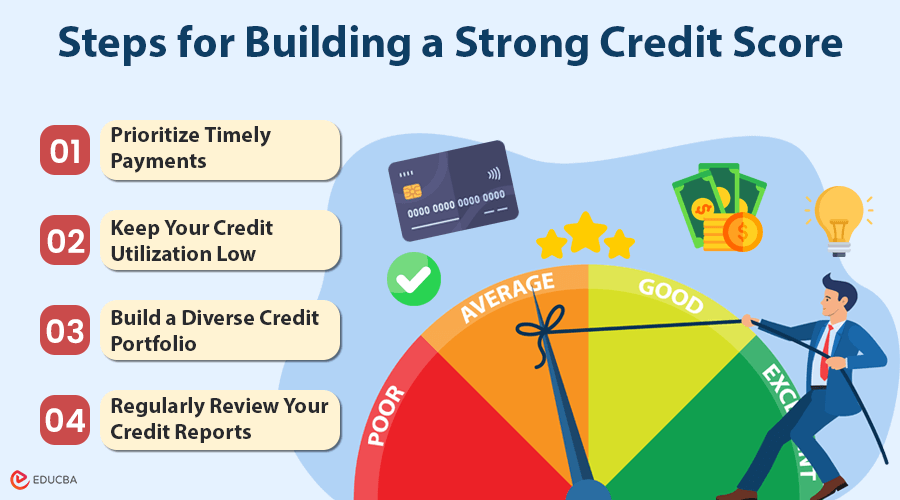

Steps for Building a Strong Credit Score

Here is how you can strengthen your credit score with simple yet effective strategies.

#1. Prioritize Timely Payments

Timely payments are among the most important factors in building a good credit score. Payment history constitutes 35% of your FICO score, making it a key factor in determining your creditworthiness. Regularly paying your bills on time demonstrates financial responsibility to lenders and helps build a clean payment history. Consistently paying on time helps you avoid penalties and improves your creditworthiness, making it easier to qualify for loans with better terms and lower interest rates.

Tip: Set up payment reminders or automate payments to ensure you never miss one. Timely payments can also reduce late fees and other unnecessary expenses, keeping your financial situation stable.

#2. Keep Your Credit Utilization Low

The percentage of your available credit that you are using is known as credit usage. It is important because it accounts for 30% of your credit score. To strengthen your credit score, maintain your credit utilization below 30%, with an ideal range between 1% and 10%. Regularly monitoring your credit utilization and setting up balance alerts can help you avoid overspending and maintain a healthy credit score.

Tip: Pay off your balances before the statement date to ensure a low reported utilization. Increasing your credit limit is another way to reduce your use percentage without going over budget.

#3. Build a Diverse Credit Portfolio

Diversifying your credit portfolio is essential for enhancing your credit score and managing financial risk effectively. For tailored guidance on managing your credit and investments, seeking financial advice Sydney can provide personalized strategies to optimize your financial health. By diversifying your borrowing methods, you reduce risk and show lenders that you can effectively manage different types of credit. A diversified portfolio makes you more appealing to lenders and helps increase your credit score over time.

Tip: To improve your credit mix, aim for a balance between revolving credit (e.g., credit cards) and non-revolving credit (e.g., personal loans).

#4. Regularly Review Your Credit Reports

To keep your credit score high, you must regularly check your credit report. Your score may suffer if your credit record has errors or inconsistencies. By checking your report, you can catch and dispute errors, ensuring your credit profile is accurate. To keep your credit score high and safeguard your financial future, you must have a clean credit record.

Tip: Obtain a free credit report annually from the three major credit bureaus and monitor your credit regularly. This will keep you aware of any changes and allow you to address discrepancies promptly.

#5. Implement Long-Term Credit Strategies

Building a strong credit score requires consistent effort over time. Long-term strategies include diversifying your credit portfolio, managing credit utilization, and maintaining a history of timely payments. By consistently monitoring and managing your credit, you can ensure a long-term positive impact on your credit score.

Tip: For better credit evaluations, consider strategies like hedging credit risk, diversifying investments, and using stress testing. These techniques help manage credit exposure and minimize potential losses, ensuring your credit profile remains strong.

Final Thoughts

Building a strong credit score is necessary for good financial health and is easier than you think. You can improve your score over time with consistent on-time payments, low credit utilization, and a diverse credit portfolio. Remember, your credit score is a marathon, not a sprint. Stay on top of your credit habits, and the rewards will follow. The effort you put into building a more decisive credit score will pay off in the long run.

Recommended Articles

We hope this guide on building a strong credit score helps you understand the key steps to improving your financial health and securing better opportunities. Check out these recommended articles for more tips on managing credit and achieving long-term financial success.

- Maintain a Good Credit Score

- Consequences of a Bad Credit Score

- Credit Score Rating Scale

- Credit Limit